The drivers of cryptocurrency adoption have been the subject of several analytical papers over the years.

Some would emphasise the safe-haven role of Bitcoin, often referred to as ´the digital gold´ in reference to the traditional gold safe-haven.

The decorrelation between the dollar value (DXY Index) and the Bitcoin price (BTCUSD), as well as Bitcoin’s intrinsic properties like its limited supply, could position Bitcoin as an inflation hedge. Others highlight Bitcoin's role as a sovereign reserve currency, noting its potential to attract foreign capital for countries and the ability of dollarized economies like El Salvador to effectively ´print money´ through Bitcoin mining initiatives, thereby reducing their debt.

Morgan Stanley recently pointed out that ´Bitcoin’s market capitalisation is currently around the value of Switzerland’s GDP´ and counts ´106 million (…) owners worldwide´. The size of the Bitcoin economy theoretically makes its currency (BTC) a serious ´Sovereign Reserve asset´ candidate, as evidenced by El Salvador's decision to make Bitcoin legal tender in September 2021 and launch Bitcoin Bonds for financing.

Another perspective emphasizes the growth style of cryptocurrencies, drawing a parallel between cryptocurrency and equity asset classes, both falling into the riskiest category of an asset manager’s portfolio institutionalisation is expected to increase the correlation between cryptocurrencies and equity, as seen with the approval of Bitcoin ETFs by the SEC.

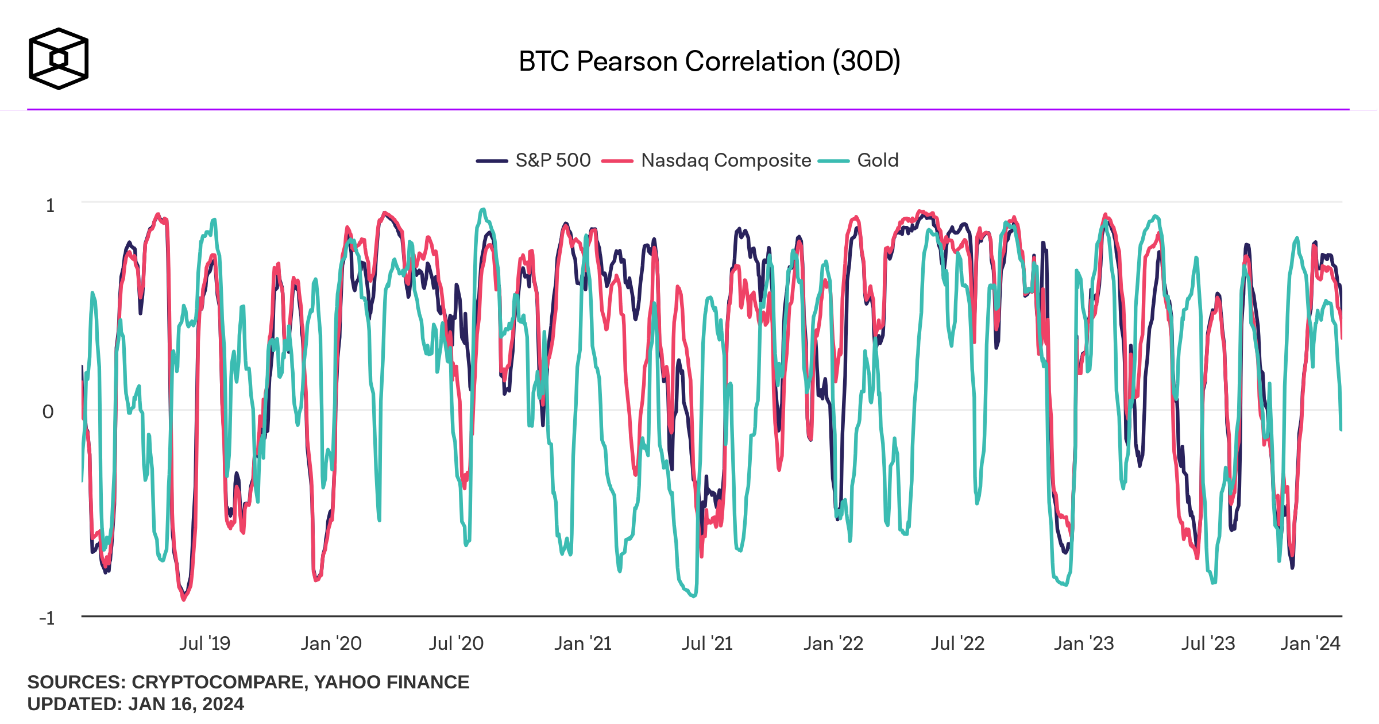

Over the relatively short history of cryptocurrencies, arguments and case scenarios both supporting and dismissing analytical statements exist. Examining the historical 30-day correlation between Bitcoin versus Gold or Bitcoin versus major equity indexes reveals fluctuations between -1 and +1, indicating a complex relationship between Bitcoin, Gold, and Equity markets. This complexity underscores the importance of cryptocurrencies as diversifiers: reasonably adding cryptocurrencies to an investment portfolio can enhance risk-return metrics.

In the following, we will specifically focus on bull regimes and the potential impact of global economic factors on performance. We are only scratching the surface to present what we believe are some of the most important economic foundations of cryptocurrency bull runs.

Monetary Policies and Central Bank Impact

Cryptocurrency markets often react to changes in traditional monetary policies. For instance, when central banks adjust interest rates or implement quantitative easing measures, it can influence investor sentiment and capital flows into cryptocurrencies.

Quantitative easing (QE) increases the money supply and is typically implemented to prevent a liquidity crisis, as seen in events like the 2008 financial crisis, where a lack of liquidity led to Lehman Brothers' bankruptcy. Additionally, QE aims to promote investment and facilitate credit, thereby supporting overall economic growth. Intuitively, a portion of the liquidity injected through QE tends to be directed towards risky endeavours or sectors, such as the crypto sector. The more substantial the QE measures, the greater the inflows we can expect into the crypto sector, contributing to the bull run.

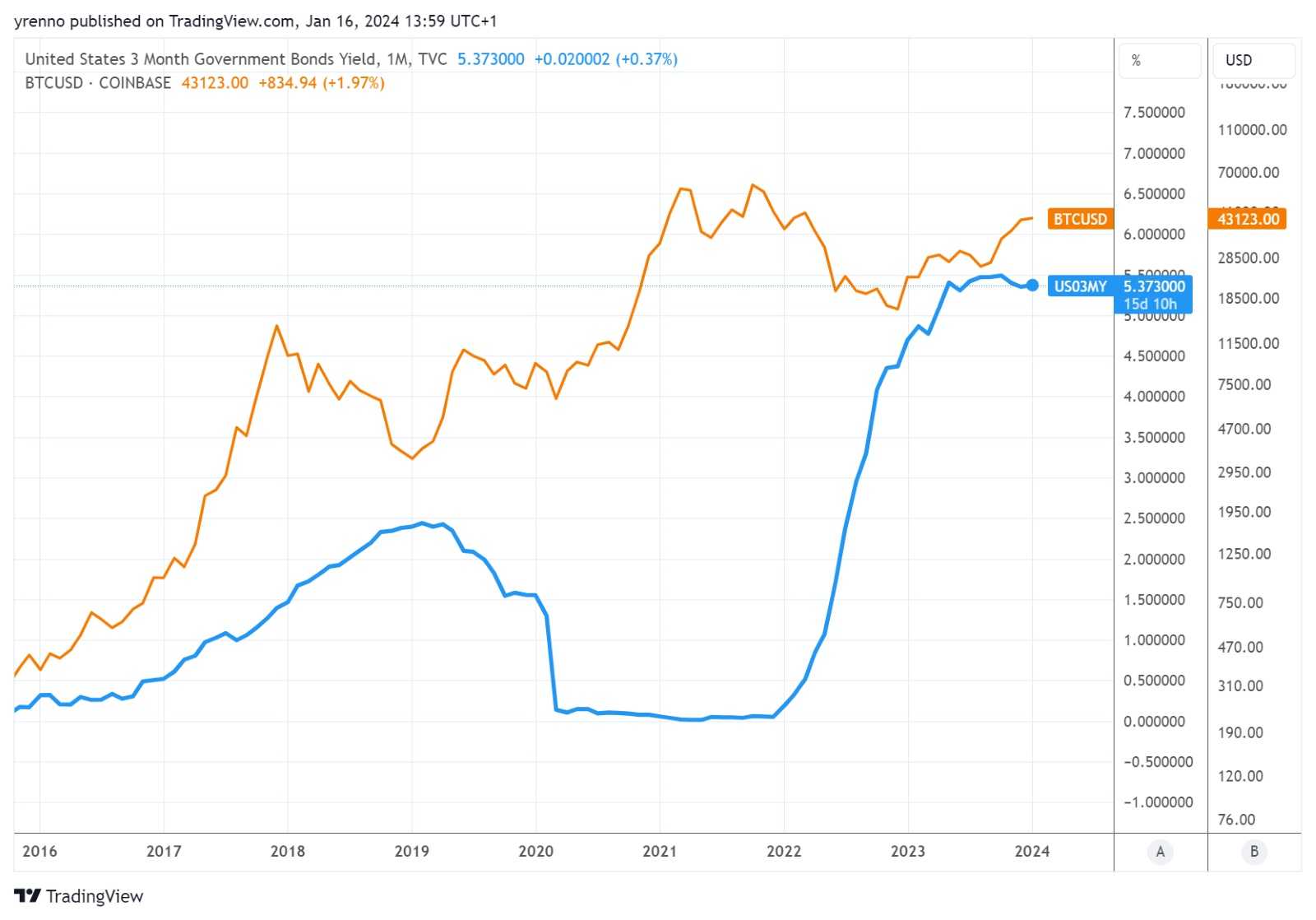

In contrast, a restrictive monetary policy decreases the money supply and is characterized by Quantitative Tightening (QT) measures or high-interest rates. Such a policy aims to remove liquidity and restrict credit. In a high-interest rate regime, traditional fixed-income investment solutions become more appealing, creating competition for the crypto sector. For instance, investing in T-bills is currently more attractive than staking ETH on Lido (3.5% to 4.4%). Therefore, a restrictive monetary policy is likely to limit investments in cryptocurrencies.

While it is challenging to directly establish the impact of QE on the cryptocurrency market, it is reasonable to assume that QE could erode confidence in fiat currency, indirectly bolstering alternatives like cryptocurrencies.

Examining the log-performance of Bitcoin (orange line) in relation to the Federal Reserve Interest Rate levels (blue line), it appears that a high-interest rate could impede the growth of the crypto market. Observing the 3-month government bond yield, the last bull runs did commence in low-interest rate regimes.

The interconnected nature of global trade and geopolitical events plays a crucial role in cryptocurrency markets. Trade tensions, international agreements, or political instability can lead to increased interest in cryptocurrencies as alternative assets or safe havens.

One of the main advantages of cryptocurrencies is that they facilitate cross-border transactions. Moreover, the more decentralised they are, the more likely they are to facilitate consensus.

Since 2022, high inflation has been driven by soaring commodity prices, including food and energy, resulting from increased geopolitical tensions.

In Turkey, the inflation rate almost reached 65%, prompting the Turkish population to seek financial refuge in cryptocurrencies (Bitcoin and stablecoins). As the country entered the dreaded FATF grey list in 2021, crypto regulation accelerated in 2023 to enhance transparency in the sector, focusing on ´licensing´ and ´taxation´, according to Reuters. Argentina and Nigeria have also witnessed accelerated Bitcoin adoption due to high inflation.

In the most politically unstable countries, such as Lebanon, peer-to-peer exchanges are common when cryptocurrency exchanges are prohibited.

There are no clear expectations for abating tensions in 2024, as it is a US presidential year. Higher tensions could exacerbate a potential rally in 2024.

Conclusion

Examining past bull runs provides valuable insights into the economic drivers of cryptocurrency market surges, such as those observed in the 2017 and 2021 Bitcoin rallies. This historical perspective, while informative, only scratches the surface of a complex and dynamic landscape. Additionally, the significant impact of regulatory developments cannot be understated. Increased scrutiny or regulatory clarity can either propel or hinder future bull runs. Therefore, staying informed and adaptable in response to the evolving regulatory landscape is crucial for assessing the sustainability of cryptocurrency market trends and making informed investment decisions.