For the vast majority of Wirex users, platforms like ours represent an innovative and convenient alternative to existing banking channels. Jaded by limited opening hours, costly transactions and waiting in line to speak to a cashier? Simply download the Wirex app, verify your account and discover just how limited your conventional bank account is.

In this context, stablecoins such as DAI or Tether represent something of a novelty - a means for investors to mitigate the serpentine volatility of ‘traditional’ cryptocurrencies like Bitcoin or Ether. For the average crypto enthusiast, stablecoins lack the glamour and allure of their non-stablised tokens; after all, no one has ever become a millionaire speculating on DAI.

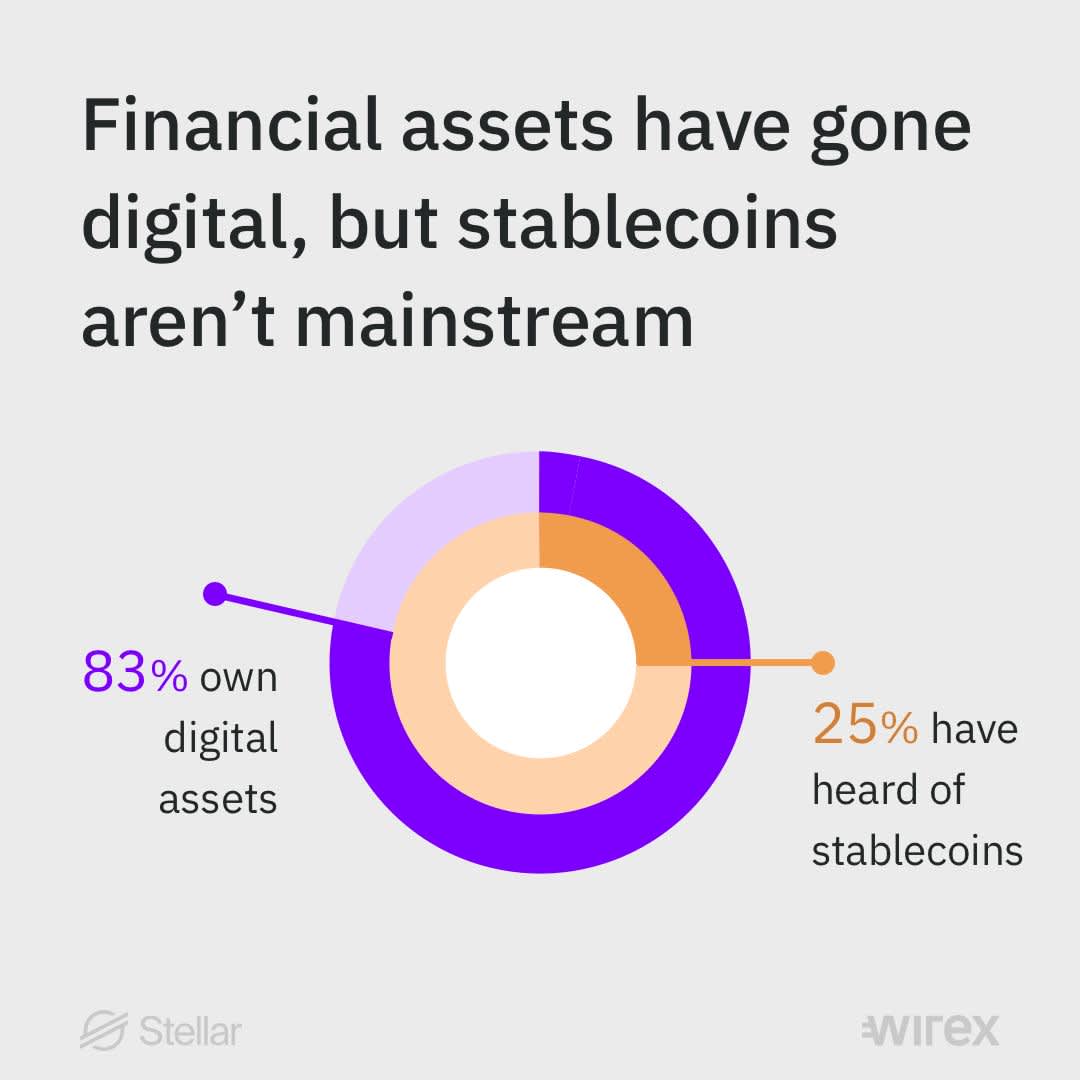

A recent report by the Stellar Foundation and Wirex revealed that, while 84% of participants knew of cryptocurrency, only 25% had heard about Stablecoins. And that’s just fine. After all, stablecoins are unlikely to play a significant role in the lives of people with easy access to both conventional and neo-banking services...yet.

So, what are they good for?

A 2017 study funded by the Bill & Melinda Gates Foundation revealed that roughly 1.7 billion adults around the world lack access to mobile or branch-based banking services. That means that nearly a quarter of the world’s population simply doesn’t have a stable form of monetary storage and exchange. Even in the USA, which commands the world’s largest economy, up to 7% of the population is firmly considered ‘unbanked’.

There are myriad reasons why a person might be unbanked, including patchy financial infrastructure, poverty, remoteness or a lack of official ID documents. Fortunately, stablecoin -powered transactions have the potential to help all unbanked people, whatever the cause.

The recent proliferation of both mobile banking services and blockchain-driven payments solutions allow anyone with a mobile internet-capable device access to secure, modern financial services that are far more flexible and convenient than their conventional counterparts. However, having access to low-cost, near-instant crypto transactions is useless unless the transacted currency maintains a stable value. Who wants to receive a payment that is worth less than the amount originally sent?

That’s where stablecoins really come to the fore. Because they are pegged to stable asset, whether that’s a fiat currency or commodity, stablecoins combine the benefits of crypto-powered payments with the price stability of a traditional ‘fiat’ currency. By using stablecoins as a means of transferring value, members of the ‘unbanked’ can avail themselves of cheap, high-speed and truly global transactions and payments that retain their value regardless of market movements and macroeconomic factors. And it’s not just the unbanked; stablecoins could also be a game-changer in countries whose established financial infrastructure is undermined by hyperinflation (see Venezuela) and other economic uncertainty.

Cross-border payments

Studies by the World Bank show that the cost of sending $200 overseas has not changed significantly in recent years, despite an overall reduction in price since 2009. Conventional cross-border remittance continues to be slow, expensive and requires 3rd parties to facilitate payments; inconvenient and archaic in a world that enjoys enormous connectivity and near-instantaneous communication.

Stablecoin-powered transactions allow for instant settlement regardless of geography, have no pre-funding requirement, and, in the case of fiat-backed stablecoins, can be seamlessly exchanged into local currency using the existing FX market without the need for a lengthy offboarding processes. Just as significantly, fiat-pegged stablecoins fall under existing financial regulation. For consumers, that means instant, low-cost transactions and valuable peace of mind.

Merchant payments

Online transactions made through conventional channels are subject to a variety of fees, including interchange fees, assessment fees, processing fees and billing fees – the list goes on. By using established merchant payment channels like Visa and Mastercard, businesses can incur surprisingly high costs. Crypto-powered transactions offer certain improvements on traditional payment rails but are problematic due to their aforementioned volatility. Stablecoins remove the volatility issue. They allow instant settlement with no chargebacks or rolling reserve and circumvent the myriad charges and fees imposed by traditional payment processors. Because of this, stablecoin-powered transactions could save merchants between 3%-9% compared to conventional credit and debit card payments.

Machine-to-Machine (M2M)

Forecasters predict that there will be as many as 40 billion connected devices by 2022; M2M payments therefore stand to play an enormous role in the payment infrastructure of the future. Fast, scalable, globally available and low-cost, stablecoins are an ideal medium of exchange for M2M payments. Watch this space.